|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Remortgage No Credit Check: Exploring Your Options and Understanding the ProcessUnderstanding Remortgaging Without a Credit CheckRemortgaging can be a beneficial financial decision for homeowners seeking better loan terms. However, not everyone is comfortable with the credit check process. Understanding the possibility of a remortgage no credit check is crucial for those concerned about their credit history. Why Opt for a No Credit Check Remortgage?

Alternatives and ConsiderationsWhile a no credit check remortgage might sound appealing, it's important to consider alternatives and the implications of such a decision. Alternative OptionsExploring other options like a best heloc rates az can offer competitive rates without the need for a remortgage.

How to Proceed with a No Credit Check RemortgageIf you decide to proceed with a no credit check remortgage, it's important to follow certain steps to ensure you make an informed decision. Steps to Take

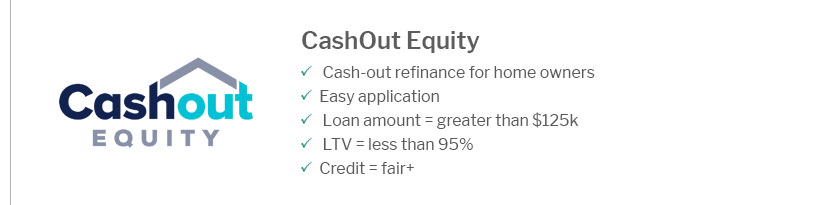

For veterans, exploring a va home loan refinance can also be a worthwhile consideration, offering benefits tailored to military members. FAQWhat is a no credit check remortgage?A no credit check remortgage is a refinancing option where the lender does not perform a credit check as part of the application process. This can be advantageous for individuals with poor credit history. Are interest rates higher for no credit check remortgages?Yes, typically interest rates are higher for no credit check remortgages because lenders take on more risk by not assessing creditworthiness. It's important to weigh the costs and benefits before proceeding. Can I switch to a traditional mortgage later?Yes, you can switch to a traditional mortgage later if your credit score improves, potentially securing better interest rates and terms. This flexibility can be beneficial for future financial planning. https://www.bankrate.com/mortgages/home-refinance-options-for-people-with-bad-credit/

Instead, anyone with a USDA loan who has made the last 12 months' worth of mortgage payments on time can qualify. In addition to no credit check ... https://www.churchillmortgage.com/no-credit-score-loan

All home loans go through an underwriting process, but no score loans need to go through a manual underwriting process. This means an underwriter will review ... https://www.lendingtree.com/home/mortgage/how-to-get-a-mortgage-with-no-credit-score/

Yes, you can get a mortgage even if you have no credit score, or if you're looking to avoid a credit check because of bad credit.

|

|---|